FreedomBankers

We help families and business owners use specially-designed whole life policies to create safe, liquid cash they control without relying on Wall Street or big banks.

Is Freedom Banking a Fit for You?

You’re a high-income earner tired of watching your 401(k) rise and crash with the market.

You’re a business owner who wants a reliable source of capital without begging banks.

You’re a real estate investor who wants predictable, liquid cash for deals.

You value math, control, and guarantees over hype and speculation.

Learn how to redirect your cash flow, generate liquidity, and build generational wealth.

Take control of your cash flow, eliminate financial stress, and create a banking system that puts you back in charge, not the institutions.

WHAT WE DO

The FreedomBankers Triad

Pillar 1 — Educate: We teach you the principles of the Infinite Banking Concept so you understand how money truly works, and how to make it work for you.

Pillar 2 — Strategize: We build a personalized cash-flow plan designed to give you liquidity, control, and long-term financial certainty.

Pillar 3 — Implement: We help you set up, structure, and optimize your own banking system so you can grow wealth safely and predictably.

How Infinite Banking Works with FreedomBankers

Fund a specially-designed policy: A dividend-paying whole life policy is structured for maximum cash value, minimum death benefit.

Grow safe, predictable cash value: Your cash value grows every year and is accessible without market risk.

Borrow against it like your own bank: Use policy loans to fund cars, business, real estate, or debt payoff while your cash value keeps compounding.

Recycle and expand your system over time: As your policy grows, your “private banking” capacity grows too.

What to Expect When You Book a Discovery Call

Step 1. Discovery Call (20–30 min)

We learn about your goals, current accounts, debts, and time horizon. You get honest feedback if IBC fitsor doesn’t.

Step 2. Custom Freedom Banking Blueprint

If it’s a fit, we build a simple, numbers-driven strategy showing how a policy (or policies) could work in your situation.

Step 3. Implementation & Setup

We handle the application and underwriting process, keep you updated, and help you start using your policy correctly from day one.

Step 4. Ongoing Coaching & Reviews

Each year, we review your progress, update your strategy, and help you keep using your system to reach your goals.

Don't worry, no hard pitches. If it’s not a fit, we’ll tell you.

Historical Stories of Entrepreneurs Using Life Insurance

Disclaimer: These are widely cited historical examples of how prominent individuals and families are reported to have used cash value life insurance. They are for educational purposes only and are not guarantees of results or endorsements of any specific strategy.

Walt Disney

In the early 1950s, Disney's vision for a family-friendly amusement park was rejected by traditional financing sources. Rather than abandon his vision, Walt Disney created a separate company called WED Enterprises in the early 1950s and pursued a multifaceted financing strategy.

He borrowed $50,000 against his participating life insurance policy to provide seed capital for WED. Additionally, he sold his second home and took out a $60,000 life insurance loan (documented through Commerce Trust) in 1954 to continue funding development.

When Disneyland opened on July 17, 1955, it attracted 3.6 million visitors in its first year of operation and has since hosted more than 700 million guests. This success demonstrated the power of using whole life insurance's cash value as a financial tool and created a blueprint that other entrepreneurs have since followed to fund business ventures without relying on traditional bank financing.

JCPenney

James Cash Penney, founder of JCPenney, famously used loans from his permanent life insurance policy to make payroll and keep his stores operational during the Great Depression, a time when banks and traditional credit sources were unavailable due to financial turmoil. In 1929, facing cash flow shortages and with credit markets dried up, Penney utilized the cash value of his policies to cover day-to-day expenses and pay employees a move that helped sustain his business through an economic crisis.

This bold action is often cited as a classic real-world example of how business owners have used whole life insurance policy loans not just for emergencies, but as a strategic financial resource to maintain stability and protect the livelihoods of their staff when traditional options fail. The success of this approach contributed to the legacy of JCPenney and demonstrated the practical benefits of having access to cash value through life insurance for both individuals and businesses.

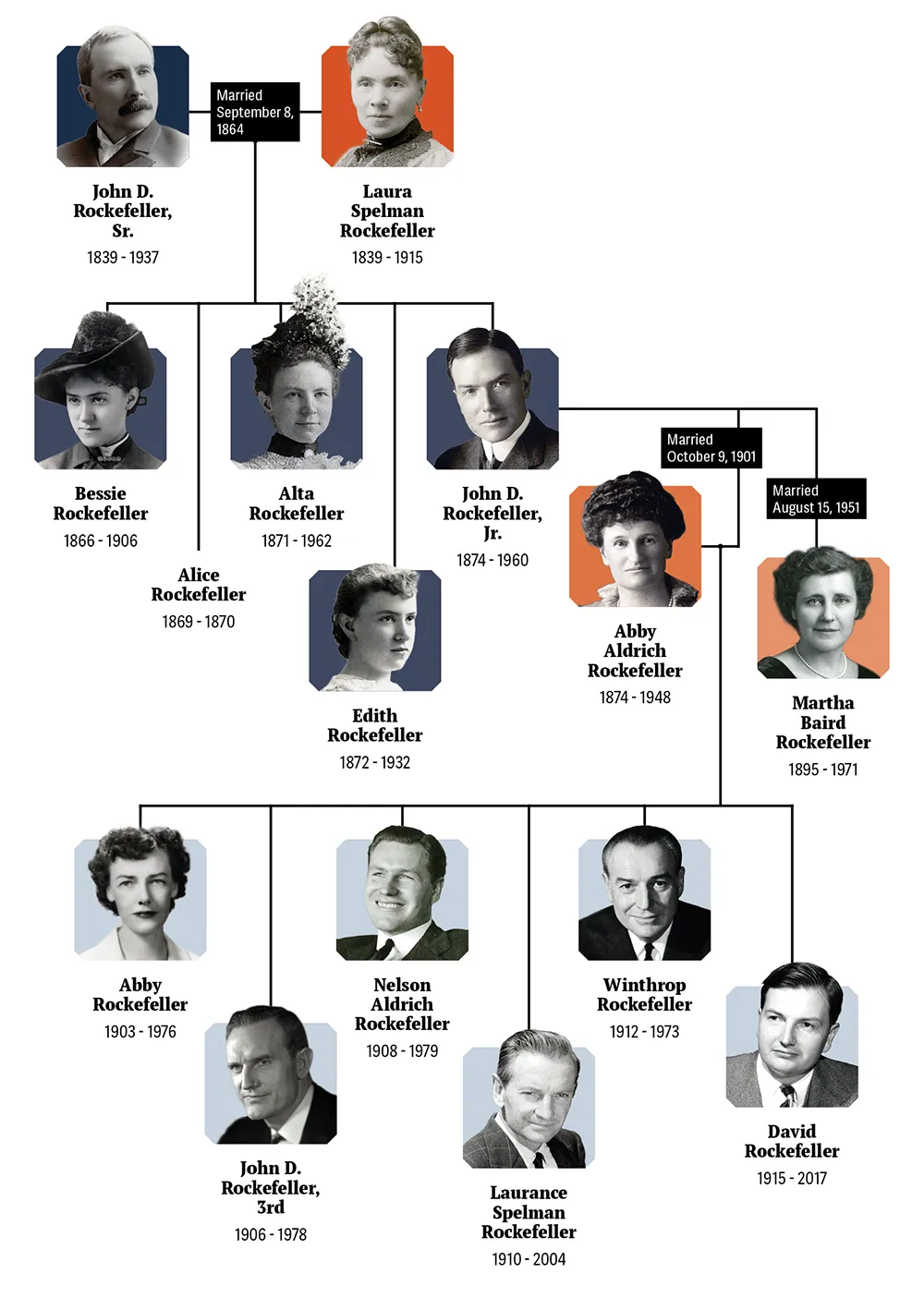

The Rockefeller

The Rockefeller family has indeed built and preserved an estimated $10 billion in wealth across six generations through a sophisticated combination of whole life insurance policies and trust structures. Their strategy demonstrates how permanent life insurance, held within irrevocable family trusts, serves as a financial engine for multigenerational wealth preservation and growth.

The cornerstone of the Rockefeller approach involves placing large whole life insurance policies on each family member, with these policies held within irrevocable family trusts. These policies are often "overfunded" early on meaning premiums are paid above the minimum required to build cash value quickly while providing substantial death benefits. The cash value serves as a growing reserve that can be accessed for liquidity needs, while the death benefit ensures a tax-free payout to the trust when a family member passes away.

The Rockefellers employ what's known as the "waterfall method," where family members who inherit policies use death benefits to pay off loans and fund new policies for the next generation. This creates a self-perpetuating cycle of wealth, with the death benefit of one generation fueling the premium payments for the next, ensuring continuous liquidity and reinvestment. This combination of strategic life insurance, trust structures, disciplined governance, and diversified assets has been critical to preserving and multiplying their wealth over more than 150 years.

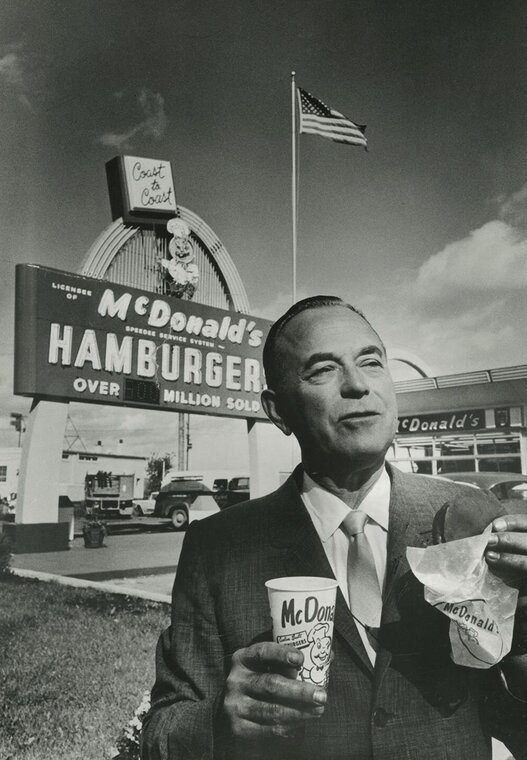

McDonald's

Ray Kroc, who turned McDonald's into a global fast-food empire, used the cash value from his life insurance policies during the early, cash-strapped days of the business. When Kroc faced significant challenges in covering payroll and operating expenses, he borrowed against two life insurance policies to ensure that key employees could be paid and to sustain operations at a critical moment for the company.

These funds didn't just cover salaries they also financed an ambitious early marketing campaign, including the creation of Ronald McDonald, the mascot that became central to the chain's branding. Kroc did not take a personal salary for eight years, relying on his own resources and life insurance cash value as a source of liquidity to keep the business afloat and moving forward when bank loans were hard to secure.

Kroc’s use of life insurance policy loans as a financial bridge allowed him to stabilize McDonald's during its formative years, eventually leading to massive expansion and long-term success for the franchise. This strategy is often cited as a classic example of how entrepreneurs have harnessed the features of whole life insurance to solve real-world cash flow challenges.

Why FreedomBankers?

We lead with education and math, not hype.

We design policies for maximum control and flexibility, not just a big commission.

We show you exactly how the numbers work so you can make an informed decision.

We started FreedomBankers because we were doing everything “right” by traditional standards like working hard, saving diligently, trusting banks and Wall Street and still feeling uneasy. The more we looked under the hood of conventional financial advice, the more we saw a system designed to keep people dependent: money locked away, exposed to market swings, and constantly flowing through institutions that profit whether you win or lose.

Discovering the Infinite Banking Concept (IBC) changed that. We realized there was a way to create cash flow, security, and control without gambling in the market or handing over all the power to banks. But we also saw how often IBC was misunderstood, oversold, or poorly structured leaving families confused instead of confident.

FreedomBankers exists to fix that. We started this company to teach, not push products to show people how money really works, how to keep it working for them, and how to build a legacy on purpose, not luck. When IBC is done right, it’s not a magic trick or a get-rich-quick scheme; it’s a clear, disciplined system that gives you back control of your capital, creates certainty in an uncertain world, and helps you build wealth that actually stays in your family.

Not Ready to Talk Yet? Start with the Financial Freedom Book by Thomas Farrar

Get a simple, 1-page breakdown of how Infinite Banking works, who it’s for, and the key numbers you need to understand before you ever talk to anyone.

You’ll also receive 4–5 short emails that walk you through real examples and answer common questions.

Unsubscribe anytime.

Ready to See If Freedom Banking Fits Your Situation?

Schedule a free, no-pressure Discovery Call and walk away with clarity, even if we never work together.